Agriculture, forestry and fishing

The growth of Northern Territory's (NT) agriculture, forestry and fishing industry is a useful indicator to reflect economic activity in the NT's regional and remote areas. It has important linkages to other sectors of the economy, including retail and wholesale trade, manufacturing and transport. In this section, analysis is provided on activity and production for live cattle and buffalo exports, as well as other livestock products and exports, horticulture, fisheries and forestry.

Economic contribution | Contribution to employment | Agriculture | Horticulture | Fisheries | Forestry | Explanatory Notes

The agriculture, forestry and fishing industry is a significant employer and source of economic activity in regional and remote areas of the NT. The industry has important linkages to other sectors of the economy, including retail and wholesale trade, manufacturing and transport. In the past few years, this industry has been performing below long-term averages reflecting a number of seasonal fluctuations and horticultural biosecurity setbacks, which affected production levels.

Economic contribution

- In 2023-24, the agriculture, forestry and fishing industry contributed $1.4 billion to the NT’s economy, up by 9.9% from the previous year.

- As a percentage share of gross state product (GSP), the industry contributed 3.4% in 2023-24, below the 10‑year average of 3.6%.

- The industry’s output can, however, vary significantly from year to year due to changes in production as well as seasonal conditions, and changes in global and domestic demand for NT commodities.

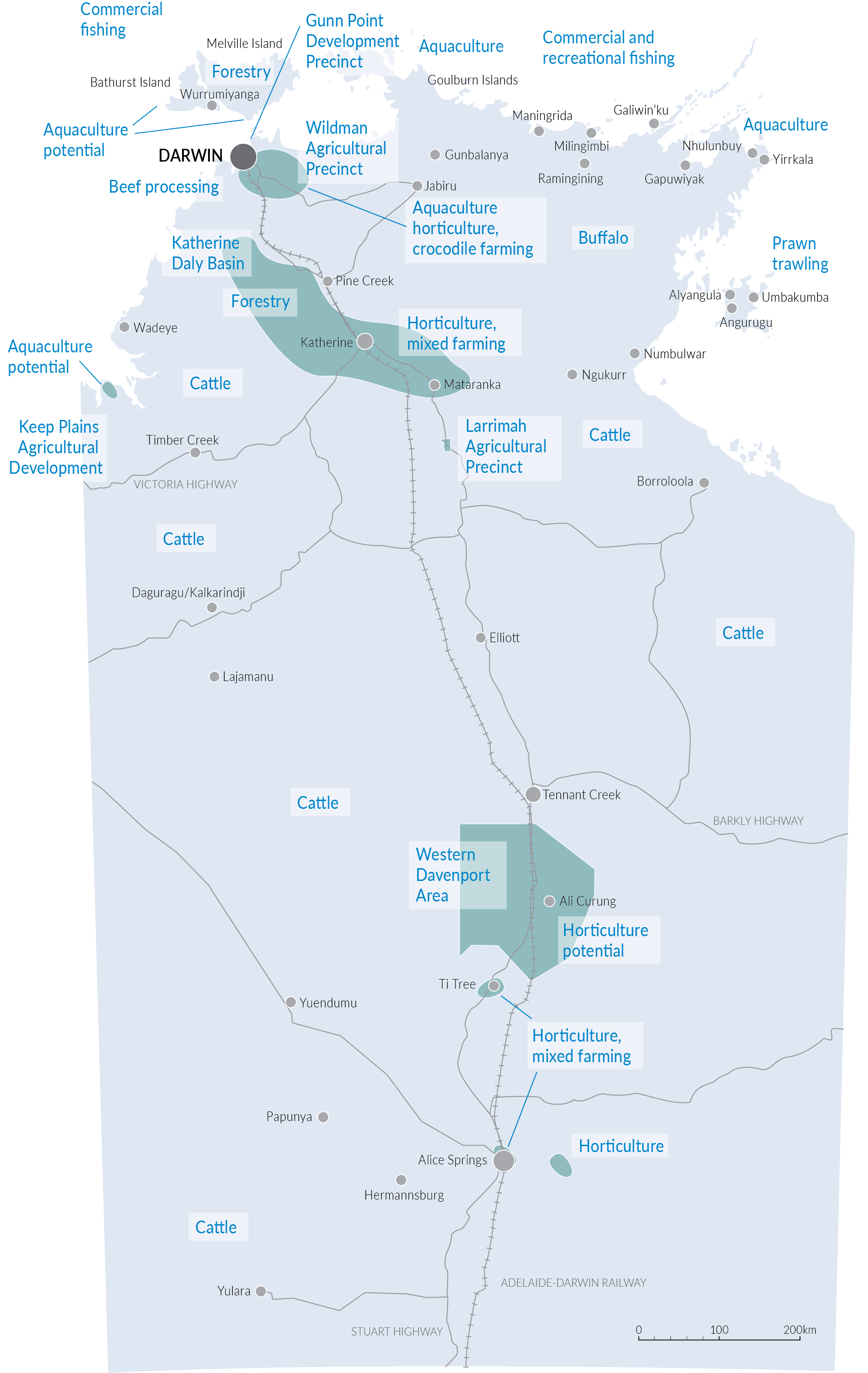

Map 1: Northern NT Agriculture, Forestry and Fishing1 (click to enlarge)

1 This map is produced from various sources. Department of Treasury and Finance cannot guarantee the accuracy, currency, or completeness of the information. To be used as a guide only.

Source: Department of Treasury and Finance; Department of Agriculture and Fisheries

Contribution to employment

- In 2023-24, employment in this industry fell by 5.4% and accounted for 2.1% of the total resident workforce in the Territory (2,915 employed) (Chart 1), above the 10‑year average (2,761 employed).

Agriculture

Live Cattle

- In 2024, around 598,000 heads of live cattle left the NT’s borders to both interstate and overseas destinations.

- Up to 274,000 heads were shipped overseas while around 324,000 heads were moved interstate.

International Live Cattle Exports

- The NT exports live cattle to a number of countries, most of which are located in South East Asia (Chart 3).

- In 2024, international live cattle exports from the NT increased by 42% to around 274,000 head. The increase is largely due to increased demand from Indonesia and favourable weather conditions.

- In 2024, live cattle exports to Indonesia accounted for around 91% of the NT’s live cattle exports.

- In 2016, Indonesia allowed the import of frozen buffalo meat as a substitute for low value beef products, in response to high prices for Australian cattle. The Indonesian government also introduced a 5:1 feeder-breeder policy in late 2017, which was revised in July 2019 to require 5% of exported cattle be fertile breeders.

- The Indonesian government is seeking to diversify supply, with new regulation that will allow cattle imports from countries such as Brazil.

Interstate Live Cattle

- In 2024, the number of NT cattle sent interstate increased by 65% (Chart 4), while the number of interstate cattle moved in the NT declined by 28%.

- In 2024, live cattle sent to Queensland accounted for around 53% of the NT’s interstate live cattle outflows.

Other Livestock

Boxed Beef

- There are several micro-abattoirs in the Territory and a single larger facility at Batchelor, which produces both frozen and fresh boxed beef and buffalo, along with the capability for a full suite of offals. The Territory currently exports processed beef and buffalo products Vietnam, South Korea, Philippines and Japan.

- In 2024, overseas boxed beef exports from the Territory recovered from no exported production in 2023 to around 247 tonnes.

- In 2024, the number of Territory cattle sent interstate for meat processing declined by 15% due to increased restocking by cattle producers.

Crocodile

- Australia accounts for 61% of the global trade in saltwater crocodile skins, with most being farmed and exported by the Territory.

- In 2023-24, revenue from the NT’s crocodile industry increased by 40% to $46 million, reflecting increased production capacity (Chart 5).

Buffalo

- Live buffalo is typically a cheaper alternative to live cattle, although constrained by wild harvest supply and high costs associated with harvesting.

- Live buffalo exports declined by 26% in 2024, with exports to Indonesia accounting for around 76% of the total (Chart 6).

Horticulture

- The NT horticultural industry is comprised of fruit, vegetables, nursery products, turf and hay. Almost all production is sold interstate. According to the NT Farmers Association, the value of horticulture production in the NT (excluding forestry) was around $389 million in 2021.

- The total value of horticultural production for 2021 comprised:

- $128 million for mango production

- $82.2 million for melon production

- $80.1 million for vegetables

- $34.6 million for field crops and fodder

- $21.5 million for nursery and turf production

- $21.3 million for cotton

- $10.9 million for NT market sales

- $10.7 million for tropical fruits (Chart 7).

- In 2024 25, the NT mango industry produced around 52% of the nation’s supply.

- Around $3.4 million worth of NT mangoes were exported overseas in the 2024 calendar year to countries including New Zealand (around 50% of the NT’s exports), Canada, United Arab Emirates, Singapore, and the US.

- Melon farming is the second-largest horticultural activity after mangoes in the Territory, producing around 23% of the nation’s supply. Current production includes watermelons, pumpkins, rock melons and honeydew melons.

Threats to Horticulture production

Various exotic plant pests and diseases found in the NT are currently impacting the horticulture production for commercial fruit and vegetable growers.

In March 2020, fall armyworm moths were detected in agricultural areas around the NT. Fall armyworms are an invasive pest that is known to threaten more than 350 plant species, including maize, sorghum, corn, fruits and vegetables. The NT Government is working closely with other state and territory governments, industry groups and communities to manage this outbreak.

In April 2022, mango shoot loopers were detected on a farm in the Darwin rural area, following earlier cases in Queensland last year. The pest feeds on mango tree leaves, shoots, flowers and immature fruit. It can also attack lychee trees, although there are no commercial lychee growers in the NT. The Australian Mango Industry Association is working to inform growers about the pest and available insecticides.

In May 2022, banana freckle was detected in the NT for the first time since the last eradication program ended in 2019 . The fungal disease causes spotting on banana leaves and fruit, however there is no risk to human health from consumption. The NT Government released a response plan in October 2020 to manage the outbreak.

For more information, visit the Plant diseases and pests information page on the NT Government website.

Fisheries

Crustacean production in the NT is dominated by prawns and mud crabs. Fish production largely comprises snapper, barramundi and mackerel. Aquaculture in the NT is primarily related to pearls and barramundi, with a small contribution from aquarium fish and spirulina production (the latter is used as a human diet supplement and a feed supplement in the aquaculture, aquarium and poultry industries). Reported data is the most recent available to date.

- Wild harvest production in 2023-24 was slightly below 5,000 tonnes, a decline of around 790 tonnes compared to 2022-23. The gross value of production from wild caught product also declined to $47.5 million.

- Inshore fisheries (including barramundi, mud crab and aquarium products) had reduced production in 2023-24.

- Offshore fisheries, including Demersal, Timor Reef, and Spanish Mackerel, reported a drop in production, largely due to fewer vessels in operation.

- The gross value of aquaculture production contracted slightly to $77 million in 2023-24, reflecting a slight decline in the value of pearling aquaculture although barramundi aquaculture production continued to grow.

The Northern Prawn Fisheries (NPF) reports the number of prawn catches in northern Australia, in the area between Cape York in Queensland and Cape Londonderry in Western Australia. The NPF produces four common commercial species of prawns including white banana prawns, tiger prawns, eastern king prawns and endeavour prawns. The weather and ocean conditions, particularly the level of rainfall during the wet season, are very influential on the productivity of the fishery especially for banana prawns.

- In 2022-23, NPF reported the total catch of prawns in the NT was about 2,201 tonnes, down from 2,568 tonnes (Chart 7).

Forestry

Plantation forestry is becoming an increasingly important industry and is currently the second largest production land user in the NT after cattle grazing, with more than 42,000 hectares of the NT currently used to produce forestry products in managed plantations. There are currently three plantation forestry projects in the NT:

- Acacia mangium plantations are being grown for woodchip exports on the Tiwi islands, managed by Midway Limited on behalf of the Tiwi Plantations Corporation on Melville Island.

- African mahogany is being grown in the Douglas Daly and Katherine regions by African Mahogany Australia, and is the largest plantation estate of this species in the world. It is being grown for a high‑value, sawn timber market, which includes veneer boards, floor boards and feature grade timber. These plantations have a predicted rotation of 18 to 25 years and are expected to reach maturity in 2026-27.

- Indian Sandalwood is also grown in the Douglas-Daly and Katherine regions for oil and pharmaceuticals. However, production from the Indian Sandalwood plantations is less certain following the recent sale of several properties, which will be converted to melon production.

Explanatory notes

- The analysis is based on estimates from surveys undertaken by DAF, information from a survey undertaken by the NT Farmers Association, as well as preliminary data from the Australian Bureau of Statistics on the value of agricultural commodities produced.

- Caution is advised when interpreting annual changes in the value of production for commodities reported in this chapter. This is due to changes in the scope and coverage of producers in the survey, changes in the level of detail on commodities reported by producers, large percentage changes from a small base and one‑off weather events occurring in the NT and adjoining states.

- For more data on agriculture, forestry and fishing, refer to DAF's website.